Your superannuation investment grows through:

-

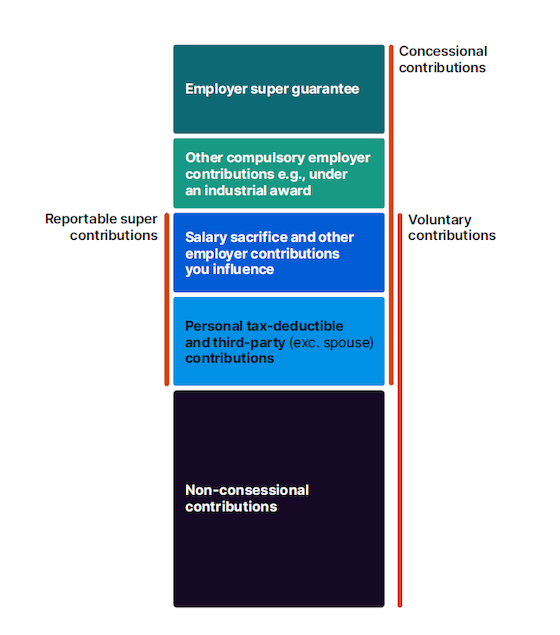

your employer’s compulsory super guarantee contributions (concessional contributions)

-

any voluntary contributions out of your pre-tax income, such as salary sacrifice and personal contributions you’re allowed as an income tax deduction (concessional contributions)

-

any government super contributions you’re eligible for

-

any voluntary contributions you or your spouse make out of after-tax income sources (non-concessional contributions).

Your pre-tax income contributions (other than super guarantee) are your reportable super contributions, which:

-

appear on your online income statement or payment summary at the end of the income year

-

are not included in your assessable income, but are taken into account in income tests for some benefits, concessions and obligations administered by the ATO and Centrelink.

Caps apply to the amounts that can be contributed to your super each financial year. If you go over these caps, you may have to pay extra tax.

While there are restrictions on contributions, and your total super balance affects how the super rules apply to you, there is no limit on the total amount you can hold in accumulation phase in one or more super funds.

Main categories of superannuation contributions

Use ATO online services to find out how much super you have based on what super funds report to the ATO or contact us and we can help.

If you don’t have a myGov account, create one and link it to the ATO.

You can also use ATO online services to consolidate your super accounts and find any accounts you’ve lost touch with, including unclaimed super that has been transferred to us.

To help compare options and choose a super fund that meets your needs you can:

-

view Choosing a super fund on ASIC’s MoneySmart website

-

use the YourSuper comparison tool.

Or you can choose to speak to us. We can help when it comes to working out strategies to grow your super.

Source: ato.gov.au

Reproduced with the permission of the Australian Tax Office. This article was originally published on https://www.ato.gov.au/individuals/super/growing-and-keeping-track-of-your-super/growing-your-super/.

Important:

This provides general information and hasn’t taken your circumstances into account. It’s important to consider your particular circumstances before deciding what’s right for you. Although the information is from sources considered reliable, we do not guarantee that it is accurate or complete. You should not rely upon it and should seek qualified advice before making any investment decision. Except where liability under any statute cannot be excluded, we do not accept any liability (whether under contract, tort or otherwise) for any resulting loss or damage of the reader or any other person.

Any information provided by the author detailed above is separate and external to our business and our Licensee. Neither our business nor our Licensee takes any responsibility for any action or any service provided by the author. Any links have been provided with permission for information purposes only and will take you to external websites, which are not connected to our company in any way. Note: Our company does not endorse and is not responsible for the accuracy of the contents/information contained within the linked site(s) accessible from this page.