These three common mistakes are easy to avoid. Making them could be costly.

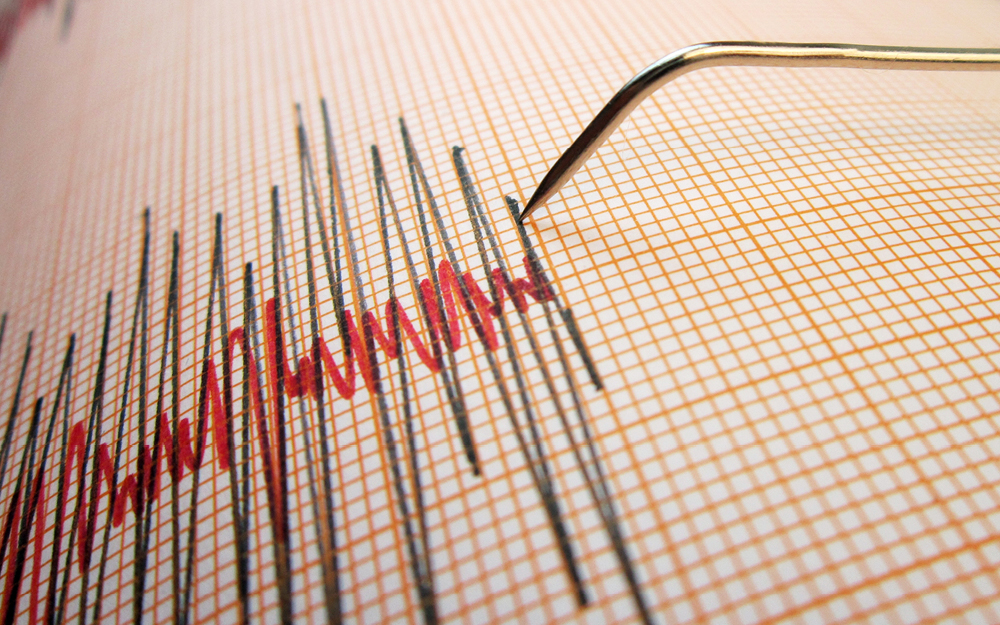

Sharp downturns on global financial markets are always unsettling.

Recently and largely in response to growing fears that the United States is heading into a recession, share markets fell heavily before rebounding.

Share markets may remain volatile over the short term. But a key lesson is that it never makes good investment sense to be swayed by the day-to-day movements of share markets into making knee-jerk investment decisions.

Rash decisions made in response to short-term events will invariably have negative long-term consequences.

What’s most important is to have a long-term investment strategy and diversified asset allocation plan, and not to deviate from that plan, even when markets do fall sharply.

Three mistakes to avoid

1. Failing to have a plan

Investing without a plan is an error that invites other errors, such as chasing performance, market-timing, or reacting to market “noise.” Such temptations multiply during downturns, as investors looking to protect their portfolios seek quick fixes.

2. Fixating on losses

Market downturns are normal, and most investors will endure many of them. Unless you sell, the number of shares you own won’t fall during a downturn. In fact, the number will grow if you reinvest your funds’ income and capital gains distributions. And any market recovery should revive your portfolio too.

3. Overreacting or missing an opportunity

In times of falling asset prices, some investors overreact by selling riskier assets and moving to government securities or cash equivalents. But it’s a mistake to sell risky assets amid market volatility in the belief that you’ll know when to move your money back to those assets.

While past returns are not an indicator of future performance, they do give a fairly good indication of the differences in returns between different types of assets.

Shares are renowned for being more volatile than other asset classes, however they have typically delivered the best returns over longer-term periods.

Share markets invariably recover their lost ground over time. So the best strategy is always to stay on your course, irrespective of sudden market jolts.

What’s most important is to have a long-term investment strategy and diversified asset allocation plan, and to not to deviate from that plan, even when markets do fall sharply.

If you’re really not sure about what to do now, or your overall financial direction, you could consider consulting a us.

This article has been reprinted with the permission of Vanguard Investments Australia Ltd. Copyright Smart Investing

GENERAL ADVICE WARNING

Vanguard Investments Australia Ltd (ABN 72 072 881 086 / AFS Licence 227263) (VIA) is the product issuer and operator of Vanguard Personal Investor. Vanguard Super Pty Ltd (ABN 73 643 614 386 / AFS Licence 526270) (the Trustee) is the trustee and product issuer of Vanguard Super (ABN 27 923 449 966).

The Trustee has contracted with VIA to provide some services for Vanguard Super. Any general advice is provided by VIA. The Trustee and VIA are both wholly owned subsidiaries of The Vanguard Group, Inc (collectively, “Vanguard”).

We have not taken your or your clients’ objectives, financial situation or needs into account when preparing our website content so it may not be applicable to the particular situation you are considering. You should consider your objectives, financial situation or needs, and the disclosure documents for the product before making any investment decision. Before you make any financial decision regarding the product, you should seek professional advice from a suitably qualified adviser. A copy of the Target Market Determinations (TMD) for Vanguard’s financial products can be obtained on our website free of charge, which includes a description of who the financial product is appropriate for. You should refer to the TMD of the product before making any investment decisions. You can access our Investor Directed Portfolio Service (IDPS) Guide, Product Disclosure Statements (PDS), Prospectus and TMD at vanguard.com.au and Vanguard Super SaveSmart and TMD at vanguard.com.au/super or by calling 1300 655 101. Past performance information is given for illustrative purposes only and should not be relied upon as, and is not, an indication of future performance. This website was prepared in good faith and we accept no liability for any errors or omissions.

Important Legal Notice – Offer not to persons outside Australia

The PDS, IDPS Guide or Prospectus does not constitute an offer or invitation in any jurisdiction other than in Australia. Applications from outside Australia will not be accepted. For the avoidance of doubt, these products are not intended to be sold to US Persons as defined under Regulation S of the US federal securities laws.

© 2024 Vanguard Investments Australia Ltd. All rights reserved.